Competing in OTT Video: How I learned to stop worrying and love niche content

The global OTT video market is growing faster than ever before, but for OTT services the battle hardens every day for subscriber wallet share and viewing time. Of the usual suspects Netflix, Amazon, Hulu and HBO, all take top spots in services ranking according to the OTT Video Market Tracker Top 10 survey, conducted by research firm Parks Associates.

OTT Video Market Tracker Top 10

- Netflix

- Amazon Video (Amazon Prime)

- Hulu (SVOD)

- MLB.TV

- HBO Now

- Starz

- YouTube Red

- Showtime

- CBS All Access

- Sling TV

Source: Parks Associates

In the US alone, there are now more than 200 subscription video services, and in Europe more than 450 OTT video services as of 2017. For new OTT services, this presents challenges. Successfully building a subscriber base in a competitive market now requires having a clear differentiator and value proposition.

A bright spot though for US markets is that more than half of all broadband households are opting to subscribe to multiple OTT services, with 15% subscribing to three or more. Even better for an OTT video service looking to take the seat next to Netflix and HBO at the OTT bundle table, this 15% segment is also the fastest-growing one according to research.

Not number 1? Then be number 3 or 4

In Europe and the US market, the foundation of all OTT service bundles for the average subscriber will in almost every case be Netflix and HBO, and Hulu, with the addition of an OTT provider of premium sports content depending on customer segment. This means that for the rest of the market the fight is on for grabbing the number 3, 4 or even 5 spot.

To achieve this, an OTT video service will need to deliver on strategies that set them apart from the competition. Content is arguably the best way to do this. Niche content in particular that caters to a smaller subscriber base, that is more loyal and dedicated than the general content consumer crowd, could be the answer. Examples of this working successfully are Magine Pro partner’s, Passionflix who offer niche exclusive and original romantic content and Docsville offering premium documentary content.

There’s still an opportunity to find your niche in the market through local or regional content, overlooked sports content for dark markets (markets for which there are sports rights but not being distributed), or even niche sports. Formula 1, for example, is now launching their standalone OTT subscription service for which they anticipate as many as five million potential subscribers and an annual income of $500m, or the global OTT service Hayu, focusing purely on reality show content.

Leverage your Strengths and Choose your Battles

Digital TV Europe Annual Industry Survey 2018

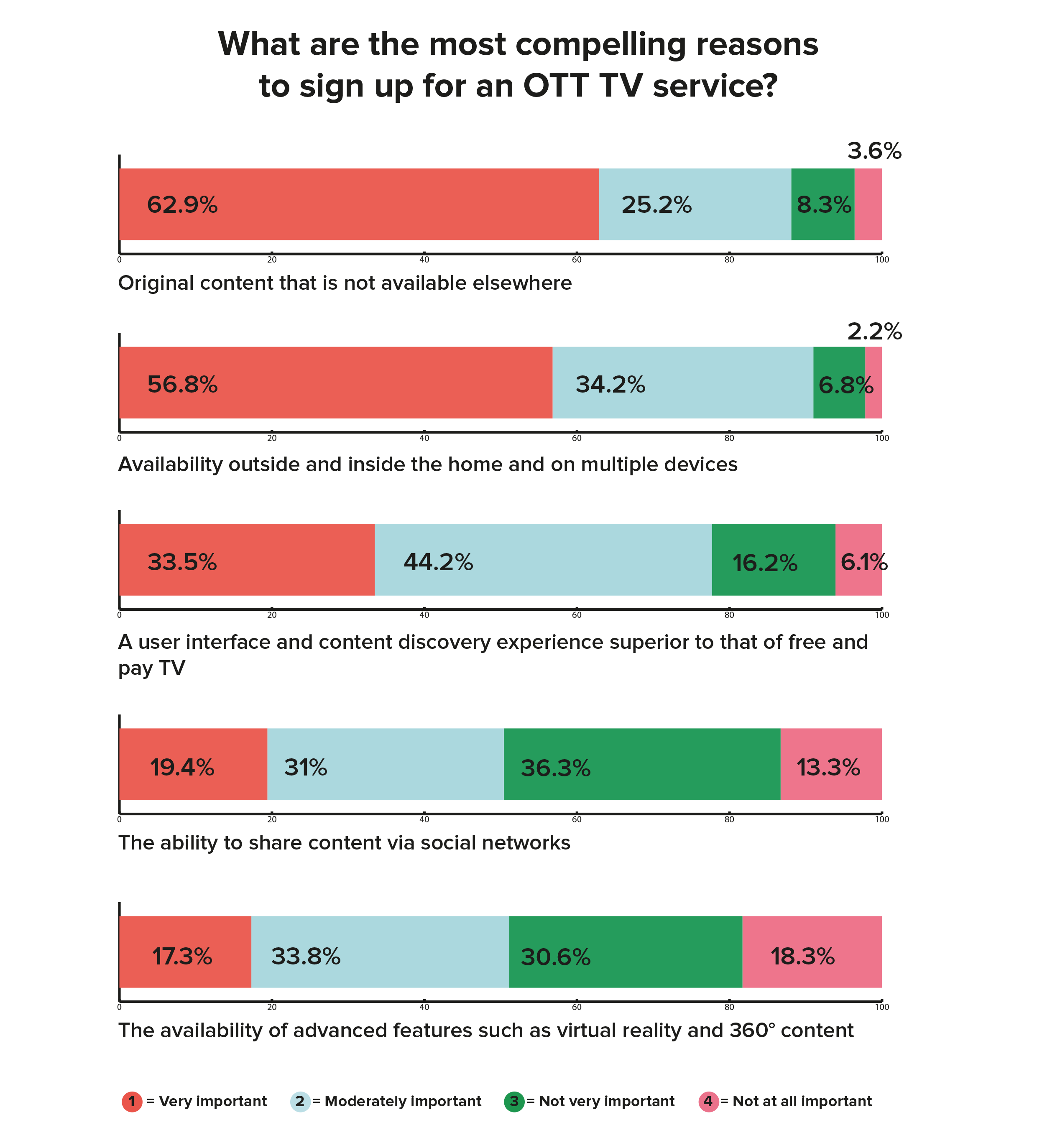

Acquire and retain subscribers in a competitive market by focusing on niche or exclusive content. Digital TV Europe recently released their annual industry survey in which 62.9% of the respondents agreed, original content that’s not available elsewhere is the most compelling reason to sign up to an OTT service. This mirrors a similar survey carried out by New York-based consulting firm, Activate Inc. where 45% of respondents said that original content was extremely or quite important for keeping a Netflix subscription.

But smaller, niche OTT services shouldn’t try to compete head-on with the likes of Netflix or HBO, as few can match their financial muscle for marketing and content. Instead, take a lesson from biblical David and compete on your own terms, leveraging your strengths to bring down the mighty Goliaths of Netflix and HBO.

The Content Echo Chamber

Digital TV Europe Annual Industry Survey 2018

Digital TV Europe’s annual survey also showed that long-tail content works best on an OTT service. Results show, 55.8% of respondents believe on-demand long-tail content is the most effective for OTT services as well as niche interest/long-tail linear TV channels at 40.3%.

This indicates that there is still plenty of room in the market for OTT services offering niche movie content, attracting viewers that are not fully satisfied by Netflix or others. In fact, in the last two years, Netflix has reduced their film library by 33% and their television shows by 26% according to a report by AllFlicks. Netflix’s decision to reduce their libraries in favor of a more streamlined content offering is a direct result of their analysis of viewer behavior. But it can be risky to rely on data to dictate content production and procurement decisions. Content will start to fall under the mandate of the majority, as Netflix will only produce and distribute content that is watched by the masses, and the masses will only watch the content produced and distributed by Netflix, creating a self-perpetuating content echo chamber.

This, however, creates ample opportunity for niche OTT services to step in. The incumbents like Netflix, Hulu, and Amazon are already starting to feel the heat from new competitors that offer exclusive content according to the consulting firm Activate Inc. as the growth of SVOD services in the US has slowed considerably over last year as the competition intensifies.

New Markets, New Opportunities

It’s also worth pointing out that the APAC (Asia Pacific) market should be of special interest for new entrants. In the next five years, tremendous growth is expected in the region thanks to increased mobile adoption, amplified broadband expansion, and enhanced purchasing power, creating a new battleground for new OTT entrants and established players alike.

There are interesting times ahead for the OTT industry, and we’re just getting started! Magine Pro offers new entrants or established players anywhere in the world, the possibility to hit the ground running with a trusted and proven OTT video service. Our experience in the consumer market means we know what it takes to beat the competition and can help you succeed. Check our products and case studies to learn more about Magine Pro and how we’ve helped others get their OTT business off the ground.

If you want to learn more about Digital TV Europe’s annual industry survey and the findings, check out our roundup and download the full report here.