Operators and OTT, live together in perfect harmony

“The modern media company must develop extensive direct-to-consumer relationships, we think pure wholesale business models for media companies will be really tough to sustain over time.”

-AT&T Chairman-CEO Randall Stephenson during his latest investors call explaining his company’s vision of how to stay relevant to consumers in the fight against Netflix and Amazon, and the rationale behind AT&T’s acquisition of Time Warner.

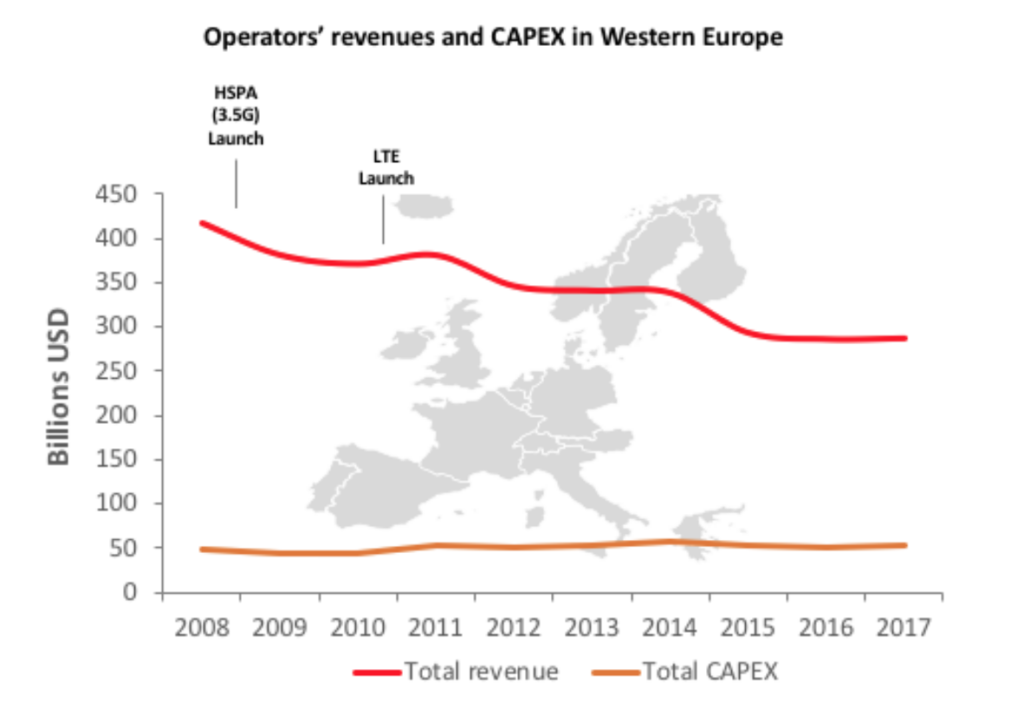

Randall’s statement is understandable, as Mobile Operators today are feeling the pressure to find the next revenue growth driver. Over the last 10 years, Operator’s revenues have been in decline (as shown in the Northstream graph below), with investments (CAPEX) required for the growth of mobile data consumption remaining flat.

Source: Northstream

Vertical integration is the name of the game

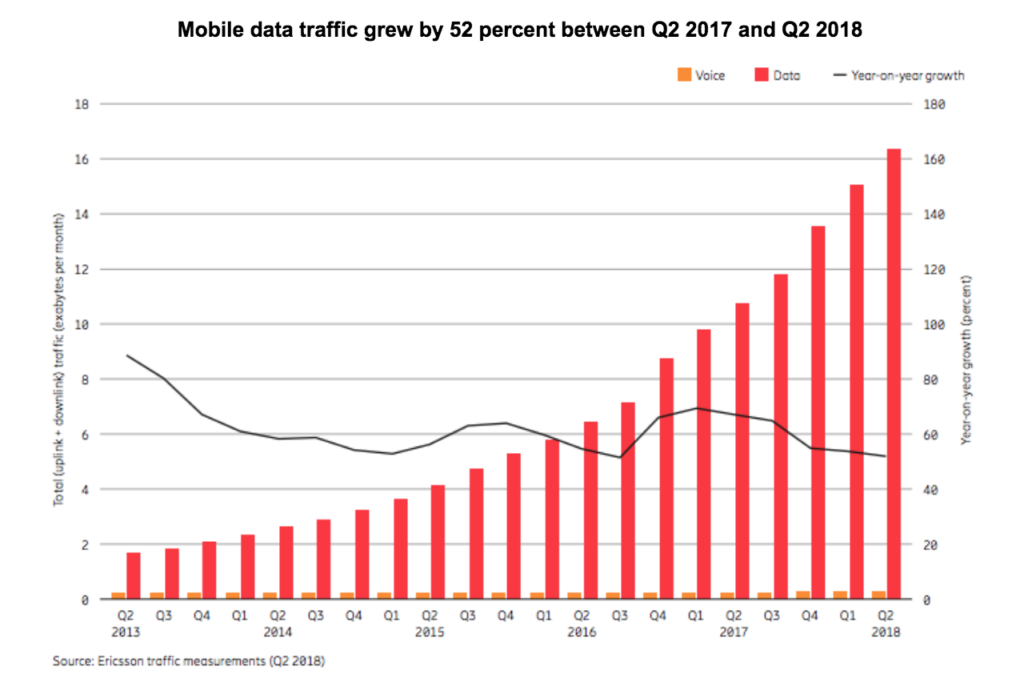

As the graph below demonstrates, mobile data traffic is still showing tremendous growth, and with cord cutting reaching new heights, it’s no surprise Operators are taking a page from the ol’ strategy playbook and begun acquiring content and media companies to achieve vertical integration.

Source: Ericsson

The simple objectives of such vertical integration-deals are scale and to retain customers by expanding the control and ownership of the value chain, bundling all consumer services such as TV, Internet, Phone and OTT into one discounted package and locking the consumer in the Operator ecosystem. Recent examples of this being AT&T’s acquisition of Time Warner and Swedish Telia’s acquisition of Bonnier Broadcasting.

Through acquisitions like these, Operators can consider themselves providers of everything from infrastructure to content production and consumer technology. However, it’s important to remember that the only consistently profitable business Operators have ever had is provision of connectivity and infrastructure. There are many examples of Operators who have dabbled with innovative new services in an attempt to compete head-on with start-ups when market dynamics and status quo had been disrupted. Who, for example, remembers the bold aspirations and goals of Vodafone 360? Or the ambitious operator application service platform, IP Multimedia Subsystem (IMS), which was to be a worldwide deployment of mobile telecommunications networks to offer Operator managed Video, Voice and Business services online, without forcing subscribers to change carrier.

The market, however, ended up going in a different direction, with the ecosystems eventually being controlled by Apple and Google, and OTT new entrants providing superior Voice, Messaging and Video services, as well as ease of use for consumers, bypassing any attempt of an Operator ecosystem. Now, Operators find themselves locked in cut-throat competition with these OTT challengers for what they considered their core business.

The Operators’ Gordian knot

So how then can Operators untie their Gordian knot of 1- exploding growth of mobile data traffic, 2- flat or decreasing revenue, and 3- competing with innovative and fast-moving OTT challengers? Just as Alexander the Great disentangled the impossible knot by simply cutting it loose with his sword, so should Operators. Rather than clinging to legacy market perceptions and ideas, resulting in ever more complex and unclear new initiatives, Operators should approach the issue as simplistic and pragmatic as possible. They should acknowledge the areas in which they excel, connectivity and infrastructure, and acknowledge what OTT challengers excel in, which is providing innovative and superior consumer services and content.

By entering into partnerships with OTT companies, Operators are able to leverage their true core competencies and provide superior customer experiences through OTT partnerships. We’re already seeing such partnerships becoming more common, with video services being the most popular area of collaboration between Operators and OTT.

Other interesting examples of partnerships are Operator investments in OTT aggregators and platforms. For example, Telia’s investment in SolidTango, enabling the Operator direct access to a multitude of niche OTT services and content channels. And with the increased adoption of multiple OTT service subscriptions by consumers, as well as the growth of niche market OTT services, partnerships like these open up new levels of personalised packages that Operators could offer their customers.

Come together, right now

Operators and OTT companies are in a great position to work together and leverage each other’s strengths, rather than attempting to out-compete each other by limiting distribution or denying access to content. It is clear that what is best for consumers will in the long run also always be best for the companies serving said consumers, and those consumers are now voting more ruthlessly with their wallets than ever before. In a recent report by BCG, Video aggregators and Distributors are at risk of losing $30 Billion in profit as a result of current changes in the media market dynamics. Even though the future is still up for grabs, not all companies have the scale to keep up, and thus BCG predicts that “their best option is to pick a partner with a constellation of complementary content and assets under the best possible terms.” In the online video market of tomorrow, the writing on the wall is that Operators and OTT companies either succeed together or fail divided.

AT&T’s Randall Stephenson went on to also share his view on Netflix:

“I think of Netflix kind of as the Walmart of (video), HBO is kind of Tiffany. It’s a very premium, high-end brand for premium content.”

This is an interesting view given that Netflix received 118 Emmy nominations this year, which was more than HBO. Netflix will also spend 3x times as much as HBO on content productions this year. It would be interesting to know how Stephenson defines the high-end difference between Netflix and HBO. It does seem AT&T is committed to trying yet again to untangle their Gordian knot in a conventional way, but if it didn’t work before, will it work now?

If you’re attending IBC this year and want to learn more, come by the IBC Content Everywhere Hub where I will be discussing these topics and others in the panel discussion; “TELCO TV: THE CONVERGENCE OF BROADCAST AND TELECOMS”, on Monday the 17th, at 3.30 pm. You can also stop by the Magine stand 14.C25.

OTT Players: Go big screen, or go home?

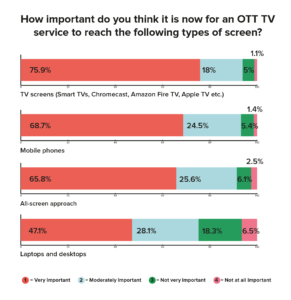

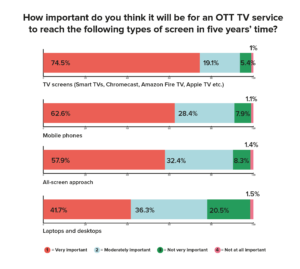

For an OTT video service, being on every platform and device that your subscriber might have is considered standard in the media and OTT industry. Big screen streaming through devices such as Smart TVs, Apple TV, Android TV and Roku is still perceived as the most important for viewers though, both as of today and in the next five years according to Digital TV Europe recent industry survey:

Being able to reach your viewers on any thinkable device as an OTT service makes perfect sense, right? No, not necessarily so.

Having your service available on any device is, of course, a great value proposition and expands the customer experience but there are downsides. For every new device added, there is also added complexity and cost in maintenance, customer support, and subscriber communication.

The importance put on being present on every imaginable device is also based on faulty assumptions. When it comes to OTT streaming, all devices and screens are not created equal. Our internal data shows that 70-80% of streaming takes place through web clients, smartphones, and tablets. Set-top boxes and dongles for big-screen viewing, such as Apple TV and Android TV, actually only account for between 2-3% of streaming, which means the cost of launching and maintaining an app for those devices is often higher than the revenue generated through subscriptions tied to them. Keeping the features and quality of service on those apps up to par with the most heavily used mobile devices may also prove challenging, resulting in viewer frustration and lessening of the customer experience. There is, of course, the marketing value of being on major platforms and devices, even if the viewers choose to consume the service on other devices, but this should always be a well-thought-through decision.

Rather than immediately going for the ‘be on every device’ strategy, consider what the expectations are for the chosen devices and how they fit into your commercial strategy and acquisition plan. The risk otherwise, as we have seen from experience, is that preparations are made to launch a service on six or more devices, only to realise that three of the devices account for +80% of the streaming and subscriptions, which means the remaining devices are almost pure cost-only drivers. For some markets though, there are ‘must-be-on’ devices that shouldn’t be overlooked. In the German market, for example, Amazon Fire accounts for 40% of streaming for our partners and should be on the priority list of anyone looking to launch a service in the German market.

Start small screen, grow big screen

We recommend all new OTT service entrants focus on web, iOS, and Android in the first phase. These devices are often where the bulk of the subscriber acquisition and uptake take place, so the viability of the business can easily be tested and evaluated. Netflix for example, had 82 % of their year-on-year growth for 2016 and 2017 driven by increased access via smartphones.

This same trend was highlighted recently in a report by Ooyala, which showed that mobile video plays could soon reach a 70% market share, and that smartphone viewing is three times that of tablets. Even more so for emerging markets, where smartphones are more common and accessible than tablets and big screen devices. In the same study, mobile video dominated in EMEA (Europe, Middle-East, Africa) market with the level of engagement at 63.5%.

At Magine Pro, we enable our partners to hit the ground running. Our Premium product offers clients an off-the-shelf OTT service with web and native iOS and Android apps. For those already decided that big screen devices are critical for launch, or looking to expand the number of devices that the Magine Pro Premium product offers, we also provide Apple TV, Android TV and Smart TV apps for the big screen, which are available as add-ons through our Premium X offering. We’re able to accommodate any OTT service wherever they may be in their growth journey.

You can find out more about our OTT platforms and services here. To get updates on latest news, products, and blog posts, sign up for our monthly e-newsletter.

Show me the money – SVOD or AVOD for monetising OTT?

Digital TV Europe’s recent survey found Subscription video-on-demand (SVOD) came out as the top choice of business model for OTT services. No surprise there, given that SVOD is indeed a great monetization model and often the go to-monetization model for any new OTT venture as it ensures a steady recurring revenue and lock-in effect on users. And you can’t complain about market forecasts either, as by 2022 the European SVOD market is expected to nearly double, and more than 450 million global SVOD subscriptions are expected.

In addition, SVOD makes it possible to receive parts of your monthly revenue with no relating costs. Data collected from our partner SVOD services show that only 60 to 70% of paying subscribers are active monthly users, meaning that four out of ten paying subscribers never accessed or used the OTT service in a given month. This means users are paying a subscription fee without actually using the service, a scenario all too familiar to anyone with a rolling gym subscription. Although short-term this could be considered free revenue, the long-term risk is that those non-active users will eventually churn and opt-out of the service altogether. The premise of getting revenue with no associated support or streaming costs might sound alluring but to achieve real long-term success, the objective should always be to strive for engaged rather than inactive subscribers.

Make sure no money is left on the table

In the same OTT survey, advertising-supported video-on-demand (AVOD) was considered a less promising business model for OTT services in terms of its potential to deliver value to the service provider. Understandable, as sustaining revenue through advertising only can be complex and challenging, but it doesn’t need to be. Today, AVOD should be considered a complementary strategy to an SVOD or Transaction-supported video-on-demand (TVOD) business model.

Incorporating an AVOD-model ensures you leave no money on the table. Monetizing through ads means you can offer limited free content to users that are hesitant to pay a subscription or transaction fee upfront. The strategy then would be to push to convert these free users to paying subscribers through upsell activities, increasing your average revenue per user (ARPU) and the customer lifetime value. In an ever more competitive market, using an ad-supported freemium model will also help with marketing efforts as you’ll be able to attract and onboard new users who want to try the service for free first. You can still monetize through ads as you convert them to paying users.

Even though AVOD doesn’t offer the same steady revenue stream or the same level of ARPU as SVOD, you shouldn’t overlook the revenue opportunities from video ads. Case in point, according to research by MonetizePros.com, YouTube’s cost per thousand impressions (CPM) range from $18 to $24 depending on the type of ad shown and Hulu’s average CPM can be as high as $28. Looking at connected Smart TVs, a rough average is around $25 per video ad CPM. You can’t ignore these CPM levels and sources of revenue.

The increasing interest from marketers for OTT as an ad channel is also easy to understand. Viewers are spending more and more of their time watching OTT video compared to traditional TV media. According to eMarketer, 7 in 10 Americans are now consuming ad-supported OTT videos regularly, and this is expected to grow considerably in the coming years.

Another advantage of using OTT as a platform for video advertising is that it enables you to capture rich viewer data, resulting in much better targeting of relevant video ads. CBS All Access, in fact, reduced their video ad inventory (and cost) for OTT content by 25% as they were able to target audiences much more efficiently based on the detailed viewing data collected.

AVOD, coming to an OTT screen near you

We’re still only in the early phase of the shift and uptake of video ad spending for OTT video. Research by MTM and SpotX showed that at the end of 2017, 30% of all video advertising was spent on OTT services. And it’s projected that video advertising delivered over the internet to TV screens will be worth more than €825 million by 2020, with compound aggregate growth rates (CAGR) between 20 to 80% in European countries.

At Magine Pro, we believe the secret to a successful OTT business lies in a business model that combines SVOD, TVOD, and AVOD whenever possible. As part of our video solutions, we offer SVOD, TVOD, and AVOD business models, either separately or combined in an OTT service. The Magine Pro platform is also pre-integrated to SpotX ad server, enabling our partners to generate ad revenue by direct deal and programmatic advertising, and extensive ad campaign management. Essentially making it extremely easy for new OTT services to start monetizing through AVOD from launch as efficiently as possible.

You can find out more about Magine Pro’s video solutions and monetization models here. If you would like to speak with us directly via phone or email, please contact us.

Competing in OTT Video: How I learned to stop worrying and love niche content

The global OTT video market is growing faster than ever before, but for OTT services the battle hardens every day for subscriber wallet share and viewing time. Of the usual suspects Netflix, Amazon, Hulu and HBO, all take top spots in services ranking according to the OTT Video Market Tracker Top 10 survey, conducted by research firm Parks Associates.

OTT Video Market Tracker Top 10

- Netflix

- Amazon Video (Amazon Prime)

- Hulu (SVOD)

- MLB.TV

- HBO Now

- Starz

- YouTube Red

- Showtime

- CBS All Access

- Sling TV

Source: Parks Associates

In the US alone, there are now more than 200 subscription video services, and in Europe more than 450 OTT video services as of 2017. For new OTT services, this presents challenges. Successfully building a subscriber base in a competitive market now requires having a clear differentiator and value proposition.

A bright spot though for US markets is that more than half of all broadband households are opting to subscribe to multiple OTT services, with 15% subscribing to three or more. Even better for an OTT video service looking to take the seat next to Netflix and HBO at the OTT bundle table, this 15% segment is also the fastest-growing one according to research.

Not number 1? Then be number 3 or 4

In Europe and the US market, the foundation of all OTT service bundles for the average subscriber will in almost every case be Netflix and HBO, and Hulu, with the addition of an OTT provider of premium sports content depending on customer segment. This means that for the rest of the market the fight is on for grabbing the number 3, 4 or even 5 spot.

To achieve this, an OTT video service will need to deliver on strategies that set them apart from the competition. Content is arguably the best way to do this. Niche content in particular that caters to a smaller subscriber base, that is more loyal and dedicated than the general content consumer crowd, could be the answer. Examples of this working successfully are Magine Pro partner’s, Passionflix who offer niche exclusive and original romantic content and Docsville offering premium documentary content.

There’s still an opportunity to find your niche in the market through local or regional content, overlooked sports content for dark markets (markets for which there are sports rights but not being distributed), or even niche sports. Formula 1, for example, is now launching their standalone OTT subscription service for which they anticipate as many as five million potential subscribers and an annual income of $500m, or the global OTT service Hayu, focusing purely on reality show content.

Leverage your Strengths and Choose your Battles

Digital TV Europe Annual Industry Survey 2018

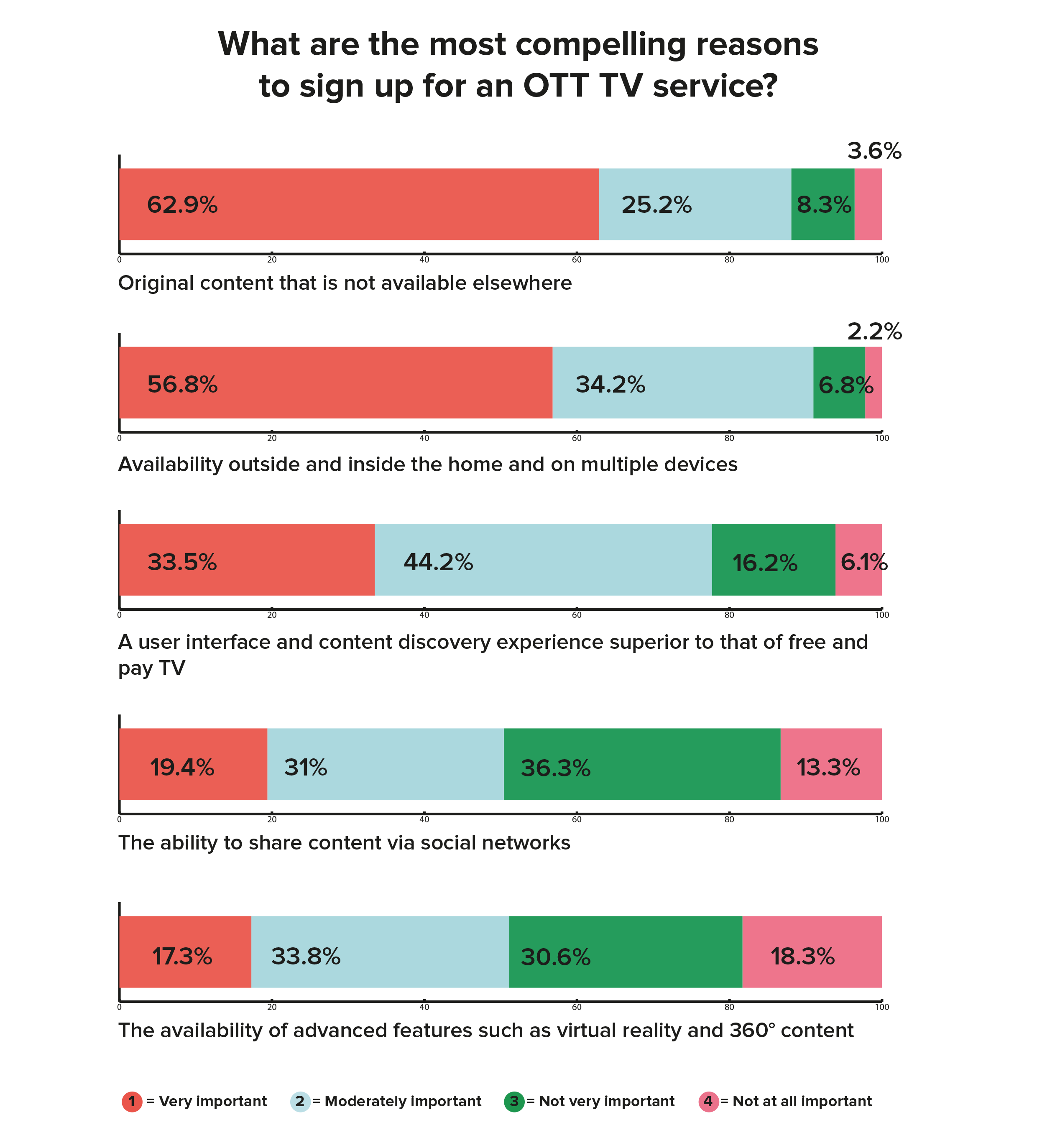

Acquire and retain subscribers in a competitive market by focusing on niche or exclusive content. Digital TV Europe recently released their annual industry survey in which 62.9% of the respondents agreed, original content that’s not available elsewhere is the most compelling reason to sign up to an OTT service. This mirrors a similar survey carried out by New York-based consulting firm, Activate Inc. where 45% of respondents said that original content was extremely or quite important for keeping a Netflix subscription.

But smaller, niche OTT services shouldn’t try to compete head-on with the likes of Netflix or HBO, as few can match their financial muscle for marketing and content. Instead, take a lesson from biblical David and compete on your own terms, leveraging your strengths to bring down the mighty Goliaths of Netflix and HBO.

The Content Echo Chamber

Digital TV Europe Annual Industry Survey 2018

Digital TV Europe’s annual survey also showed that long-tail content works best on an OTT service. Results show, 55.8% of respondents believe on-demand long-tail content is the most effective for OTT services as well as niche interest/long-tail linear TV channels at 40.3%.

This indicates that there is still plenty of room in the market for OTT services offering niche movie content, attracting viewers that are not fully satisfied by Netflix or others. In fact, in the last two years, Netflix has reduced their film library by 33% and their television shows by 26% according to a report by AllFlicks. Netflix’s decision to reduce their libraries in favor of a more streamlined content offering is a direct result of their analysis of viewer behavior. But it can be risky to rely on data to dictate content production and procurement decisions. Content will start to fall under the mandate of the majority, as Netflix will only produce and distribute content that is watched by the masses, and the masses will only watch the content produced and distributed by Netflix, creating a self-perpetuating content echo chamber.

This, however, creates ample opportunity for niche OTT services to step in. The incumbents like Netflix, Hulu, and Amazon are already starting to feel the heat from new competitors that offer exclusive content according to the consulting firm Activate Inc. as the growth of SVOD services in the US has slowed considerably over last year as the competition intensifies.

New Markets, New Opportunities

It’s also worth pointing out that the APAC (Asia Pacific) market should be of special interest for new entrants. In the next five years, tremendous growth is expected in the region thanks to increased mobile adoption, amplified broadband expansion, and enhanced purchasing power, creating a new battleground for new OTT entrants and established players alike.

There are interesting times ahead for the OTT industry, and we’re just getting started! Magine Pro offers new entrants or established players anywhere in the world, the possibility to hit the ground running with a trusted and proven OTT video service. Our experience in the consumer market means we know what it takes to beat the competition and can help you succeed. Check our products and case studies to learn more about Magine Pro and how we’ve helped others get their OTT business off the ground.

If you want to learn more about Digital TV Europe’s annual industry survey and the findings, check out our roundup and download the full report here.