Show me the money – SVOD or AVOD for monetising OTT?

Digital TV Europe’s recent survey found Subscription video-on-demand (SVOD) came out as the top choice of business model for OTT services. No surprise there, given that SVOD is indeed a great monetization model and often the go to-monetization model for any new OTT venture as it ensures a steady recurring revenue and lock-in effect on users. And you can’t complain about market forecasts either, as by 2022 the European SVOD market is expected to nearly double, and more than 450 million global SVOD subscriptions are expected.

In addition, SVOD makes it possible to receive parts of your monthly revenue with no relating costs. Data collected from our partner SVOD services show that only 60 to 70% of paying subscribers are active monthly users, meaning that four out of ten paying subscribers never accessed or used the OTT service in a given month. This means users are paying a subscription fee without actually using the service, a scenario all too familiar to anyone with a rolling gym subscription. Although short-term this could be considered free revenue, the long-term risk is that those non-active users will eventually churn and opt-out of the service altogether. The premise of getting revenue with no associated support or streaming costs might sound alluring but to achieve real long-term success, the objective should always be to strive for engaged rather than inactive subscribers.

Make sure no money is left on the table

In the same OTT survey, advertising-supported video-on-demand (AVOD) was considered a less promising business model for OTT services in terms of its potential to deliver value to the service provider. Understandable, as sustaining revenue through advertising only can be complex and challenging, but it doesn’t need to be. Today, AVOD should be considered a complementary strategy to an SVOD or Transaction-supported video-on-demand (TVOD) business model.

Incorporating an AVOD-model ensures you leave no money on the table. Monetizing through ads means you can offer limited free content to users that are hesitant to pay a subscription or transaction fee upfront. The strategy then would be to push to convert these free users to paying subscribers through upsell activities, increasing your average revenue per user (ARPU) and the customer lifetime value. In an ever more competitive market, using an ad-supported freemium model will also help with marketing efforts as you’ll be able to attract and onboard new users who want to try the service for free first. You can still monetize through ads as you convert them to paying users.

Even though AVOD doesn’t offer the same steady revenue stream or the same level of ARPU as SVOD, you shouldn’t overlook the revenue opportunities from video ads. Case in point, according to research by MonetizePros.com, YouTube’s cost per thousand impressions (CPM) range from $18 to $24 depending on the type of ad shown and Hulu’s average CPM can be as high as $28. Looking at connected Smart TVs, a rough average is around $25 per video ad CPM. You can’t ignore these CPM levels and sources of revenue.

The increasing interest from marketers for OTT as an ad channel is also easy to understand. Viewers are spending more and more of their time watching OTT video compared to traditional TV media. According to eMarketer, 7 in 10 Americans are now consuming ad-supported OTT videos regularly, and this is expected to grow considerably in the coming years.

Another advantage of using OTT as a platform for video advertising is that it enables you to capture rich viewer data, resulting in much better targeting of relevant video ads. CBS All Access, in fact, reduced their video ad inventory (and cost) for OTT content by 25% as they were able to target audiences much more efficiently based on the detailed viewing data collected.

AVOD, coming to an OTT screen near you

We’re still only in the early phase of the shift and uptake of video ad spending for OTT video. Research by MTM and SpotX showed that at the end of 2017, 30% of all video advertising was spent on OTT services. And it’s projected that video advertising delivered over the internet to TV screens will be worth more than €825 million by 2020, with compound aggregate growth rates (CAGR) between 20 to 80% in European countries.

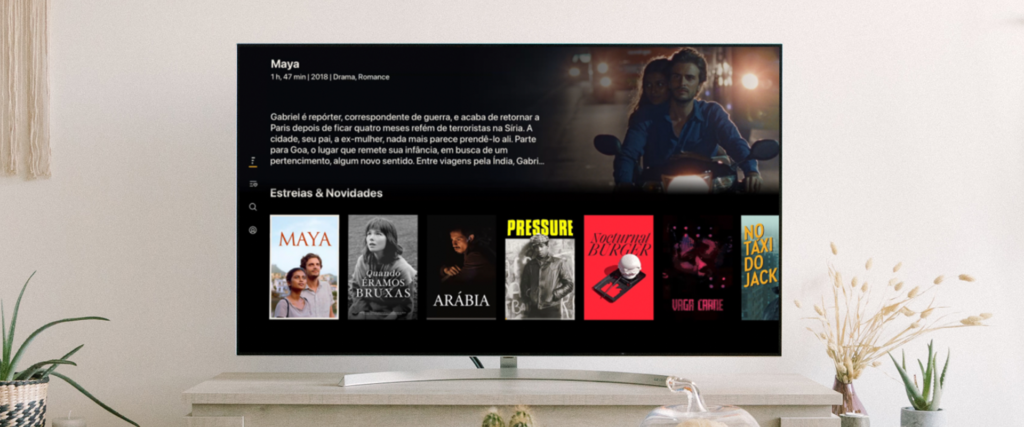

At Magine Pro, we believe the secret to a successful OTT business lies in a business model that combines SVOD, TVOD, and AVOD whenever possible. As part of our video solutions, we offer SVOD, TVOD, and AVOD business models, either separately or combined in an OTT service. The Magine Pro platform is also pre-integrated to SpotX ad server, enabling our partners to generate ad revenue by direct deal and programmatic advertising, and extensive ad campaign management. Essentially making it extremely easy for new OTT services to start monetizing through AVOD from launch as efficiently as possible.

You can find out more about Magine Pro’s video solutions and monetization models here. If you would like to speak with us directly via phone or email, please contact us.